This post briefly explores the differences and similarities of the Autonity / AFP forecast markets with the existing communities of: Kaggle, Metaculus, Numerai, and Manifold Markets.

AFP

As mentioned in the previous article, Autonity’s Autonomous Futures Protocol (AFP) is a new blockchain-based system for creating and trading forecast futures, special contracts tied to real-world data.

For example, AFP lets people trade contracts whose value depends on future data like the U.S. Consumer Price Index or jobless claims. Instead of simple yes/no bets, these contracts pay out continuously based on the final data value (e.g. the exact CPI number).

The AFP is built on Autonity (an EVM Layer-1 chain) and uses a novel design that decouples trading from clearing. In plain terms, this means any trading venue connected to AFP can let users buy or sell the same futures contracts, while all the risk/margin is handled by a shared clearing system. An Autonity blog post explains that AFP “consolidates margin and open interest across venues” to pool liquidity and capital efficiency.

In other words, markets aren’t siloed on one website. AFP’s first live trading venue is called Autex, and it has launched prediction contracts on weekly U.S. initial jobless claims and monthly U.S. CPI (inflation) data. These are called forecast futures markets, a new category of derivative where predictions become tradable assets.

The AFP’s design is very different from typical prediction sites. Instead of just betting on a binary event, traders can take positions on any continuous outcome (like a precise economic number). AFP is decentralized and uses real crypto assets (on Autonity) for trading. It is also open and permissionless: anyone can create a new forecast future on any time series data. Because of this, the AFP community sees it as a bridge between models and markets, turning statistical forecasts into tradable financial instruments.

Manifold Markets

Manifold Markets is an online prediction market platform focused on social forecasting. On Manifold, users create and trade markets about upcoming events (like elections or sports), using play money called Mana. For example, a question might be “Will the next U.S. President be a Republican?” and users bet Mana on “Yes” or “No”. Manifold’s markets use an automated market maker (Maniswap) under the hood to set prices. It was originally called Manifold Markets and even briefly allowed real-money bets (a feature called Sweepcash, now discontinued).

Similarities to AFP: Both Manifold and AFP are communities built around forecasting the future. Each allows people to make predictions about real-world events and see if their insight was right. They both create a “market” for predictions, in the sense that participants can gain or lose based on what happens. In that way, they encourage data-driven thinking and let users test their forecasting skill.

Differences from AFP: There are several big differences.

First, Manifold’s bets are binary or categorical: you typically bet on one of two (or a few) outcomes. AFP’s forecast futures are continuous contracts tied to numerical data (like a CPI value), not just yes/no questions.

Second, Manifold is a single web platform (centralized), so each market lives only on Manifold’s site. AFP markets, by contrast, can be traded on any exchange that integrates AFP (currently Autex, and potentially others). This means AFP markets share liquidity across venues, whereas Manifold markets are isolated.

Third, Manifold uses play money (Mana) with no real financial risk (trading Mana is just for fun and reputation). AFP trades use actual assets (ATN and USDC) and collateral on a blockchain, so real value is at stake.

Finally, Manifold’s community is more casual and game-like (with users casually betting on sports, politics, or tech news), while AFP is targeting quant traders and data enthusiasts who want to trade real derivatives on economic or scientific data.

- Market type: Manifold is a centralized play-money prediction market; AFP is a decentralized blockchain futures market.

- Outcomes: Manifold bets on discrete events (e.g. yes/no questions); AFP contracts settle on continuous time-series values (e.g. inflation numbers).

- Trading: Manifold’s trades stay on its own site. AFP trades happen on Autonity’s network and can occur on any connected platform (no silo).

- Currency: Manifold uses in-platform Mana (no real money risk); AFP uses real crypto assets on a Layer-1 chain (real economic stakes).

Metaculus

Metaculus is a long-running forecasting platform and community. Users on Metaculus make probability or numeric predictions about a wide range of questions, especially scientific, technological, and global trends. Metaculus features three kinds of forecasts: yes/no (binary) questions, numerical-range forecasts (give a range of a quantity), and date-range forecasts (guess when something will happen). The community submits forecasts, and Metaculus aggregates them into a consensus probability. Forecasters earn “points” for accurate predictions, and there are reputation and prize systems for top performers. Metaculus is notable for focusing on data and analysis; users can even suggest new questions, which (after moderation) get opened to everyone.

Similarities to AFP: Like AFP, Metaculus deals with forecasting real-world data and events. Both involve users making predictions about measurable outcomes. Metaculus also goes beyond binary questions by allowing numeric forecasts for things like “What will next year’s world population be?” or climate questions.

Differences from AFP: The main difference is that Metaculus is not a trading market – it’s a prediction aggregation site. Users on Metaculus contribute forecasts to a community tally; there is no actual buying or selling of contracts. There is no shared liquidity or venue integration: Metaculus forecasts stay on Metaculus. AFP, by contrast, turns each forecast into a financial derivative that can be traded for profit or loss. Metaculus uses abstract points and reputation to reward accuracy, whereas AFP uses real assets to reward gains and losses from trading. Also, Metaculus questions are usually created by the site (often academic/science topics) and chosen by a moderator team, while AFP is permissionless – anyone can spin up a new forecast market on any allowed data series. Finally, Metaculus forecasts are often about when or what specific threshold something will happen (like “Will X reach Y by year Z?”), whereas AFP’s forecast futures are directly settled on the outcome number (e.g. the exact CPI value on a given date).

- Market type: Metaculus is a centralized forecasting site (no financial market); AFP is a decentralized trading market.

- Format: Metaculus aggregates user probability/numeric forecasts and scores accuracy; AFP offers actual futures contracts that pay out based on real data.

- Currency: Metaculus uses points and occasional cash prizes for top forecasters; AFP uses crypto assets in open markets.

- Community: Metaculus is research-oriented, focusing on science/tech questions; AFP is aimed at traders and quant-modelers who want to trade derivative products.

Numerai

Numerai is a decentralized hedge fund and data science network. It runs regular data modeling competitions: data scientists worldwide download anonymous stock-market data, build machine-learning models, and submit predictions to Numerai’s weekly tournaments. Numerai then uses the combined winning models to trade a real hedge fund. Participants stake crypto (Numeraire, NMR) on their models: if their prediction is good, they earn NMR; if it’s wrong, their stake is lost (burned). Numerai famously calls itself “the hardest data science tournament on the planet” because it focuses on complex stock-return predictions. It has paid over tens of millions in NMR rewards to its community.

Similarities to AFP: Both Numerai and AFP blend forecasting with cryptocurrency and market incentives. In both communities, participants make predictions (in Numerai’s case via ML models, in AFP’s case via trades and forecasts) and can earn real token rewards. Both are “prediction games” with financial stakes tied to accuracy. Also, both appeal to quants and data enthusiasts who use models to forecast numeric outcomes.

Differences from AFP: Numerai is quite different in structure. It is not a public market – there is no open buying/selling of contracts on a marketplace. Instead, it is a closed prediction tournament specifically about stock-market data. Numerai provides data and takes in models; AFP provides markets that anyone can trade. Numerai’s participants never directly trade assets; they just submit forecasts and stake on them. AFP participants trade contracts and keep or lose money directly from prices. Numerai uses an internal token (NMR) for staking and focuses narrowly on equity returns, while AFP uses the Autonity blockchain’s assets and can be used for any agreed-upon time series (inflation, climate data, crypto metrics, etc.). In short, Numerai is a crowdsourced hedge fund contest, whereas AFP is a marketplace for forecast contracts.

- Platform: Numerai is a private modeling competition tied to a hedge fund; AFP is an open futures market platform.

- Predictions: Numerai users submit AI model forecasts on stock data (weekly); AFP users trade contracts on economic indicators (continuous).

- Incentives: Numerai uses staking of its own crypto token (NMR) to reward accurate models; AFP uses trading profits/losses on real tokens.

- Community: Numerai’s crowd is mostly data scientists working on finance problems; AFP’s crowd can include traders, students, or anyone interested in quantitative forecasting.

Kaggle

Kaggle is a well-known platform for data science and machine learning competitions. Organizations and researchers post datasets and challenge participants to build the best models (for example, image recognition, predicting house prices, or time-series forecasts). Competitors submit code or predictions, and Kaggle scores them, often with cash prizes or recognition for the top teams. Kaggle also hosts community tools (like shared code notebooks), but fundamentally it is a contest arena for solving data problems.

Similarities to AFP: Kaggle and AFP both involve forecasting and modeling data. A Kaggle competition could be about predicting next month’s economic numbers, which is similar in theme to an AFP market on the same data. Both communities encourage improving prediction accuracy and sharing techniques. Also, both platforms sometimes attract students, academics, and tech-savvy users who enjoy applied data challenges.

Differences from AFP: The differences are substantial. Kaggle competitions are offline contests, not real-time markets. Participants submit their model outputs after seeing fixed datasets, and scoring is done once per competition. There is no continuous trading or live market dynamics. In contrast, AFP is a live market where anyone can buy/sell contracts at any time before settlement. Kaggle does not involve financial trading or tokens (aside from contest prizes); it’s mostly about reputation and winning contest money. Moreover, Kaggle’s focus is broad (image analysis, NLP, forecasting, etc.) and usually one-time challenges, whereas AFP focuses specifically on prediction markets tied to time-series outcomes. In short, Kaggle is about building the best static model for a given dataset; AFP is about trading dynamic contracts based on ongoing data releases.

- Activity: Kaggle runs batch-style competitions on posted data; AFP runs live trading markets on time-series.

- Output: Kaggle outcomes are model submissions and final rankings; AFP outcomes are contract prices and P/L.

- Currency: Kaggle uses points and prize money for contests; AFP uses blockchain tokens in open markets.

- Flexibility: Kaggle has organizers who set each problem; AFP allows any user to propose a new market on any permissible data.

Summary

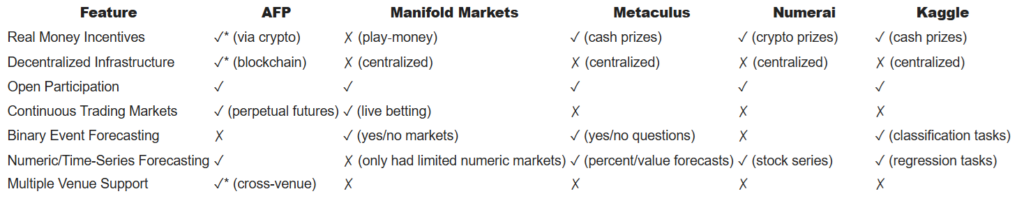

All five platforms – AFP, Manifold, Metaculus, Numerai, and Kaggle – build communities around predicting the future, but they do so in very different ways:

- Market vs Contest: Manifold and AFP are markets where predictions are traded, while Metaculus and Kaggle are more like contests or forums for submitting forecasts. Numerai is a hybrid: a contest that feeds into a real hedge fund.

- Real Money vs Play: AFP (and Numerai) involve real crypto at stake, whereas Manifold and Metaculus mostly use play-money or points (Manifold’s Mana, Metaculus’s points). Kaggle uses prize money only at contest end.

- Continuity: AFP markets are continuous and integrated across venues. The others generally have separate, siloed events or questions.

- Data vs Models: Kaggle and Numerai emphasize building models on datasets. AFP and Manifold emphasize trading predictions (though both can require modeling skill). Metaculus emphasizes individual probability estimates without trading.

In short, all these communities share the fun of forecasting, but AFP’s twist is turning each prediction into an actual financial futures contract on a blockchain, tradable across platforms. This creates a new kind of engagement: instead of just guessing or coding offline, participants can trade their forecasts in real-time markets. The other platforms either lack this trading element or focus on different domains (binary events, science forecasts, machine learning contests).

In summary, AFP is similar to these communities in its goal of leveraging crowds to forecast data, but differs by using decentralized finance mechanics and time-series derivatives to make those forecasts tradeable across venues.

The next post will dive into the world of “decentralized perpetuals.”